How To Assess Trading Strategies For Aave (AAVE)

How to evaluate your aave trade strategies: comprehensive guide

The world of cryptocurrency trading is becoming more and more complex, with many stock market markets, platforms and assets for investors. Of the many Aave (Aave) options, a decentralized loan protocol built on Ethereum has recently noticed. As one of the most popular projects in the Aave space, it offers an exciting opportunity for buyers to participate in decentralized finances (DEFI) and returning their investment. At the same time, because so many trade strategies are available, it can be a challenge that is profitable and profitable.

In this article, we are immersed in the world of cryptocurrency trading, focusing in particular on Aave and providing comprehensive guidelines for project trade strategy.

understand Aave

Before we go to trade strategies, let’s look at Aave. Aave is a decentralized loan report that allows users to borrow and borrow ETH (Ethereum) without intermediaries or traditional financial institutions. This enables a more efficient and profitable value between the parties.

aave goals functions

Before assessing trade strategies, it is important to understand the most important Aave functions:

* Decentralized : Aave works in a decentralized network, enabling users to participate in the loan process without relying on mediators.

* Decentralized financing (DEFI) : Aave is based on the Ethereum summit, enabling the creation of a DEFI protocol that allows smooth interaction between different blockchain networks.

* Borrowing and borrowing

: Users can borrow ETH from the Aave pool and are interested in their investments.

Trade strategy assessment

When assessing Aave’s commercial strategies, you should consider many key factors:

* Risk management : Commercial strategies should be planned to effectively management of risk, taking into account market variability and potential losses.

* Horizon of time : The time horizon of the investment is necessary to determine the success of the commercial strategy. Short -term buyers can apply for a more conservative approach, while long -term investors can take more aggressive strategies.

* Voatity : The price of Aave has recently experienced significant variability, which made it necessary to assess the adaptation strategy for changing market conditions.

aave joint trade strategies

Here are some general trade strategies that you can take into account when assessing Aave:

4 If you take a position on the market, you can use price movements.

- Scalping : The header includes the quick implementation of several small transactions, which aim is to benefit from short -term price fluctuations.

- Trading range : This strategy includes the identification of a specific commercial scope and the entry or exit from the transaction in this province to use price movements.

- You can use the turnover points to identify potential trade options.

Popular commercial tools for Aave

When assessing trade strategies, it is important that the appropriate tools are available. Here are some popular commercial tools that you can consider:

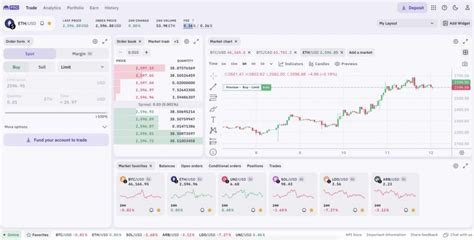

* Tradingview : This platform offers a wide range of technical and basic tools, including chart patterns, signaling and real -time data.

* Coinigy : Coinigy provides a comprehensive package of cryptocurrency analysis and tracking devices, facilitating tracking of Aave prices and other significant indicators.