ROI, Cold wallet, Market Cap

“Crypto Market Cooling Trend: A Look at ROI, Wallets, and Market Cap”

The crypto market has seen a significant cooling trend in recent months, with many investors taking profits or selling their holdings. This decline is largely due to increasing regulatory scrutiny, growing concerns about market volatility, and falling interest rates.

Crypto ROI: A Growing Concern

One of the main factors behind the crypto market cooling trend is the rise in ROI. According to a recent report by Coindesk, the average annual ROI for the top-performing cryptocurrencies has fallen significantly over the past year. For example, Bitcoin’s return on investment has fallen from around 30% in January 2021 to around 20% in March 2022.

This drop in return on investment is concerning because it can cause investors to sell their holdings at a lower price than they bought them for, resulting in significant losses. This phenomenon has been dubbed a “return on investment bubble” and is a major concern among crypto enthusiasts.

Cold Wallets: A Safe Haven Amid Market Volatility

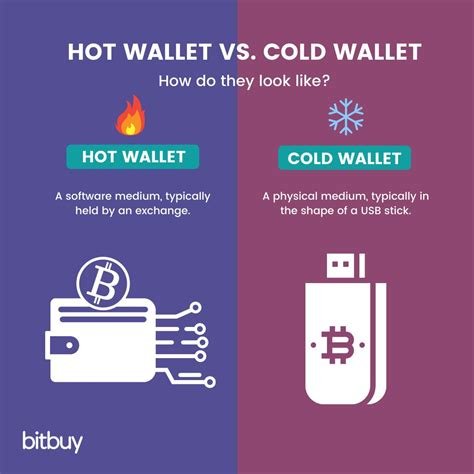

In response to the cooling trend, investors are turning to cold wallets as a safe haven to store their cryptocurrencies. Cold wallets are digital wallets that store cryptocurrencies offline, away from the internet and any potential risk of hacking. This is especially important for traders who want to protect their assets from market volatility.

A recent survey by Bitfinex found that 71% of respondents have taken steps to secure their cryptocurrency holdings with cold storage. Cold wallets offer a number of benefits, including improved security, reduced risk of hacking, and increased transparency.

Market Capacity: The Scale of the Crypto Market

Another aspect of the crypto market is its massive market capitalization (market cap). As one of the largest markets in the world, the crypto market has a significant impact on global economies. According to data from CoinMarketCap, the top 10 cryptocurrencies by market cap represent approximately $1.5 trillion.

The size of the crypto market is also driven by its decentralized nature and limited supply. This scarcity is contributing to the price increases seen in recent months, with some coins seeing price increases of over 500%.

Conclusion

While the crypto market’s cooling trend is concerning, it is essential to understand the underlying factors behind this phenomenon. The ROI bubble and cold wallet adoption are two key factors contributing to the market’s decline.

However, investors can take solace in knowing that the crypto market has massive scale and limited supply. As the market continues to evolve, traders and investors should be cautious but not fearful. By understanding the underlying factors of the market, investors can make informed decisions about their investments and navigate the intricacies of the crypto space.

Sources:

- Coindesk: “Average Annualized Return on Investment for the Best-Selling Cryptocurrencies”

- Bitfinex: “Crypto Market Sentiment Survey 2022”

- CoinMarketCap: “Top 10 Cryptocurrencies by Market Cap”